From the Archives

Building a better banking system

This page is archived content. It may refer to grants or grantmaking strategies that are no longer active. For information on our current strategies, please visit hewlett.org/our-programs.

This piece originally appeared in Thomson Reuters Foundation News.

I’m often in rooms with cleantech entrepreneurs, clean energy aficionados, and responsible investors. What unites these groups is a sense of mission—that business should return more than profit. That environmental stewardship and social equity are not afterthoughts. That we must be intentional about how we do and what we do—whether that is manufacturing a new widget or issuing a bond.

This is an encouraging trend, and the field of sustainable investment, thankfully, is rapidly pioneering smart, sustainable solutions in industries, including transportation, agriculture and water. However, one major area of untapped potential is retail banking.

Our money, no matter how small, does not just sit in a bank account dormant. Deposits are leveraged—used to lend to a number of activities. And these activities always have an impact—sometimes positive, sometimes negative. Sometimes devastating.

The banking system is broken and there are numerous examples of such. Seventeen banks syndicated $2.5 billion in credit to the Dakota Access Pipeline (DAPL), a fossil fuel pipeline that has leaked oil into the Missouri River, endangering wildlife, agriculture, and people. Various U.S. banks continue to be fined for predatory lending, discrimination against people of color, and pervasive misconduct. These examples point to the need for systemic change.

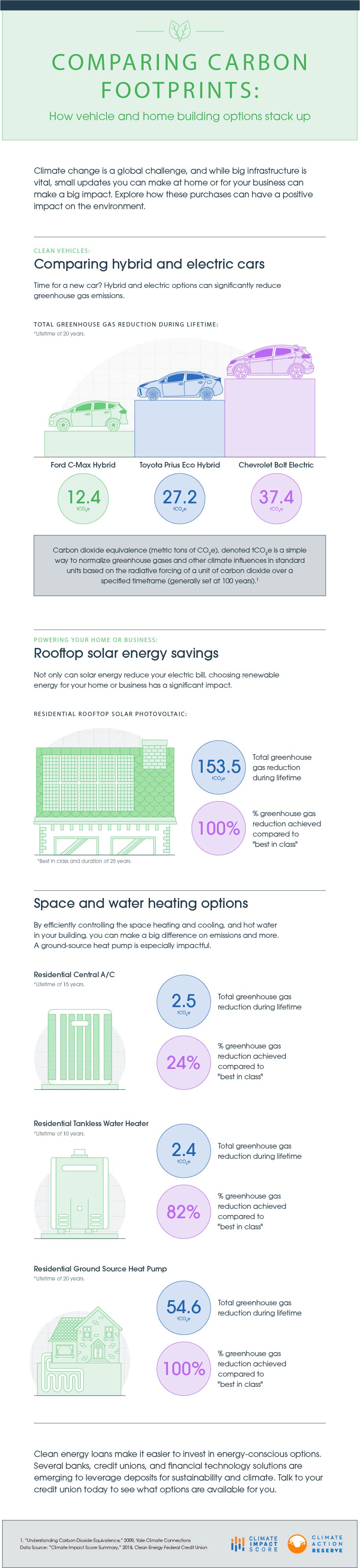

There are over $100 trillion in bank deposits globally, with over $12 trillion in the U.S. alone. And although there is ample capital to meet the needs of solving climate change, banks are falling short of supplying the capital needed to implement mature climate solutions, such as loans for distributed solar energy and electric vehicles.

The good news is that there are several U.S. banks emerging and creating options for sustainable banking, where cash and savings support projects that directly enable clean energy, clean air, and importantly, protect communities. To fuel the momentum, last year the Hewlett Foundation launched an open call for new proposals in the area of sustainable retail banking.

One proposal submitter is the Clean Energy Credit Union (CECU), a new chartered online-only national credit union that provides loans to people who want to install solar roofs, buy electric vehicles and improve their home’s energy efficiency. After less than a year in operation, CECU has received over 1,000 clean energy loan applications totaling over $18 million in demand for clean energy technologies. “We were overwhelmed with the public demand for these clean energy loans,” says Blake Jones, CECU’s volunteer board chair. Jones says most of these funding requests are focused on electric vehicle purchases and home solar electric system installations, but the loan program is also helping people do a myriad of green building improvements.

These individual banking decisions do make a huge difference in tackling climate change. For example, one residential solar electric system loan offsets 153.5 tons of carbon pollution over 25 years, equivalent to saving 152,235 pounds of burned coal. In addition to generating major carbon savings, these projects also help generate financial savings for consumers by significantly lowering their utility bills and fuel costs for many years into the future.

The success of financial institutions like CECU will certainly push other U.S. credit unions and banks to finance more clean energy loans than they otherwise would have, encouraged by the promise of clean energy lending markets.

In its first 10 years of operations, CECU is expecting to save over 20 million tons of carbon pollution. CECU and other financial institutions offering sustainable retail banking products provide a promising option for households and businesses alike to systemically support a clean environment, just by doing something they would do anyway—hold a bank account.