From the Archives

A year in review and what’s ahead for our climate finance strategy

This page is archived content. It may refer to grants or grantmaking strategies that are no longer active. For information on our current strategies, please visit hewlett.org/our-programs.

2018 marks the Hewlett Foundation’s first year with a stand-alone grantmaking portfolio for climate and clean energy finance within our environment program. The long-term (2050) ambition for this grantmaking portfolio is to mobilize at least $1 trillion annually to support interventions that further the goals of the Paris Agreement. We hope to make substantial progress toward that objective over the next five years by supporting the development of investment instruments, piloting investment vehicles, and supporting the creation of enabling environments in our key geographies (China, United States, European Union, and India).

We made significant progress this past year both in developing a plan and simultaneously beginning to execute it. Our work focused on three activities: (1) identifying gaps in the climate finance field, (2) assembling ideas for interventions to address those gaps, and (3) developing a cohesive strategy to achieve our overall goal.

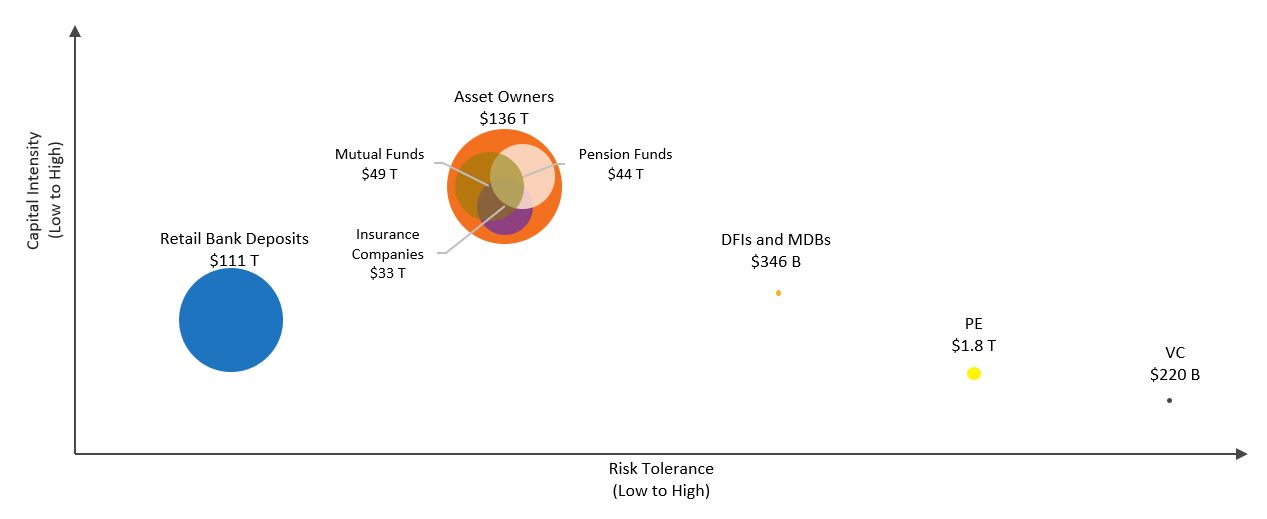

We think about finance in two distinct pools—public and private—which we then further classify along a simple spectrum from least to most risk-averse investor, where the amount of capital available in each pool is inversely related to risk. The graph below shows the size of the available capital pools. As the graph shows, available capital is well in excess of that needed to meet our long-term, trillion-dollars-per-year goal.

Selected Global Capital by Stock (2018)

Asset Owners: Represent assets held in pension funds (~32%), insurance funds (~24%), sovereign wealth funds (~5%), mutual funds (~36%), endowments and foundations (~1%) (2018). Retail Bank Deposits: Represents deposits of individuals and businesses in retail banks (2018). PE: Represents liquid assets; average deal size of $157 million (2018). VC: Represents liquid assets; average deal size by stage of $1.1 million for seed/$5.5 million for early stage/$11.5 million for late stage (2018). DFIs and MDBs: Represents disbursements from 2017 (commitments when disbursements not available). Includes CDB and C-EXIM. Click here to read graph disclaimers.

While each capital pool presents its own unique issues, we see the following broad challenges:

- Getting across the so-called “valley of death,” which strands promising technologies with the potential for significant climate impact at the R&D phase because they are still too risky to attract the kind of commercial capital needed to move them into the market; this persists at multiple stages of maturation.

- Finance and investment professionals perceive climate solutions as risky, and therefore price debt at interest rates that make project finance unattainable.

- Capital markets do not require climate change risk disclosure or accounting—distorting price signals associated with industries and investments that contribute to climate change. Among other things, this encourages continued investment in high-emitting activities that might otherwise be redirected to low-emitting technologies.

- Many promising climate change solutions are in nascent industries that cannot absorb investments in the $100 million-plus range needed to be attractive to large institutional asset owners and managers.

- There are too few options for retail investors in climate change solutions, despite ample proof of consumer demand.

Three pools of capital are focused on in our funding: risk (venture) capital, bank deposits, and institutional assets.

While venture capital (VC) may represent the smallest available pool, it is designed to achieve a level of technological breakthrough that no other private capital pool can. However, when it comes to climate change, this form of capital for supporting high-potential but high-risk nascent technology solutions is falling short. The VC model favors capital-light innovation (e.g. software, data analytics, and connected devices), and is not structured to support transformative, hardware-based innovation in power generation, transportation, manufacturing, and other infrastructure-heavy areas relevant to massive greenhouse gas emission reduction. We are thus excited to support PRIME Coalition in its inaugural philanthropic Impact Fund, which addresses this dichotomy. The fund uses a climate-impact-first approach to support solutions that each promise gigaton-scale, CO2-equivalent mitigation potential and simultaneously could become attractive to traditional VC and other finance-first, follow-on investors.

We also launched an open call for proposals in a new arena: retail banking. The immense pool of capital in this sector has till now been overlooked by climate finance philanthropy, yet retail banks could be enormously important in changing behavior and achieving significant climate impact by empowering communities; driving distributed systems like electric vehicles, community solar, ground source heat pumps, and green roofs; and creating durable, systemic change. We are now funding a number of interventions designed to mobilize bank deposits, including bringing a carbon accounting standard for lending to large financial institutions; helping establish the Clean Energy Federal Credit Union in the United States, whose lending is wholly dedicated to zero-emissions energy and transportation; conducting a behavioral study with ideas42 to understand and pilot how to persuade individual and business consumers to move assets into sustainable retail banking; and supporting the channeling of retail capital towards climate change mitigation with China’s financial technology companies and commercial banks.

An additional exciting initiative is the Climate Finance Partnership (CFP), whereby our capital, along with capital from the Grantham Foundation, IKEA Foundation, the French and German governments, and Blackrock’s managed assets, come together to form a novel blended financial instrument. With concessional capital from foundations and governments, Blackrock anticipates using the new instrument to generate investments in renewable energy, energy efficiency, energy storage, and EV infrastructure. The key is that government and philanthropic capital is not used to fund projects directly, but is instead used to de-risk private investment, greatly magnifying its leveraging effect. If successful, the new instrument can be used on a much greater scale—using billions instead of millions in government investment to catalyze hundreds of billions of private capital. Other potential benefits could be to reduce the costs of low-carbon projects and produce better market understanding of how to manage their risks. In that case, future investment might not even require the de-risking capital needed at this initial phase.

In 2019, we will continue to work with funders and partners to implement our climate finance strategy, which will include our new retail banking effort, implementation of the CFP, and a host of region-specific interventions designed to remove barriers to climate finance mobilization. We look forward to sharing our full climate finance strategy in early 2019.