My husband (a former venture capitalist) and I recently had a fascinating conversation about mergers and acquisitions in our respective sectors. If you’re the leader of a for-profit company who manages to pull off a merger, it’s a coup worth celebrating, with real financials benefits to the parties involved. Even board members get a cut. But if you’re in the nonprofit sector and announce a merger or acquisition, the most likely response is “Oh, I’m so sorry,” (and you can almost see the thought bubble: “Ouch, they must’ve run out of cash.”)

This poses a problem. There are over 1.8 million active nonprofit organizations in the US, and almost 80,000 foundations. Just looking at the campaign finance reform field, there are at least 100 organizations competing for an estimated $14M in annual foundation grants (according to the Foundation Center). For those of us who haven’t had enough coffee yet today, that works out to $140,000 per organization per year (not counting c4 and other non-foundation contributions). Needless to say, if we were starting from scratch, we probably wouldn’t design a field this fragmented.

Donors are no doubt part of the problem – both by funding a proliferation of organizations and by not properly facilitating later collaborations. That’s why the Hewlett Foundation recently co-sponsored a convening with the Bechtel Foundation on Bold Strategies for Accelerating Impact: Nonprofit Mergers and Foundation Spendouts. I’ll focus here on the former topic, which (given that we are not a spend-down foundation) was our primary area of interest.

The upshot of the convening—which was sold out, with almost double the number of attendees originally expected—is that social change efforts need (obviously) to grow their impact if they’re going to succeed. And there are only two primary ways to grow: organic (expanding one’s own scope of work or reach) or inorganic (acquiring or merging with another organization with a broader scope or audience/geographic reach than one’s own). Some argue that the latter may be easier than the former.

It’s interesting then to examine why a nonprofit (or any organization) would consider merging. There are at least three primary reasons:

- Scope: to expand an organization’s goals, competencies, etc.

- Scale: to expand nationally or internationally

- Streamline: as a cost play, to free up more resources for impact. (Though a Chronicle of Philanthropy article notes that this may be less realistic for nonprofits, where transaction costs for mergers tend to be higher—“most nonprofit groups are too small to realize the kinds of cost savings that often make for-profit mergers attractive.”)

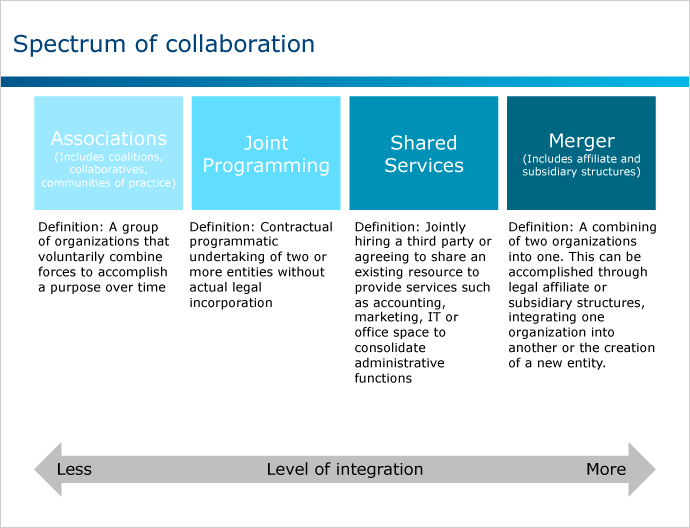

And of course not all “mergers” are created equal. Instead the nonprofit consultancy Bridgespan lays out a helpful spectrum of collaboration, the appropriateness of which may vary depending on the goal:

Spectrum of Collaboration by Bridgespan Group is licensed under CC BY 3.0.

There are obvious benefits to mergers (or other less complete forms of collaboration). So why isn’t there more of it? I’ve heard it suggested that, for mergers in the nonprofit sector, ego is the primary barrier. I suspect there’s something to that view. But maybe it’s closer to “mission attachment.” Unlike the for-profit sector, nonprofits are launched with social impact, not money, in mind. But social missions can be clouded, understandably and even unconsciously, by leaders’ attachments to their own organizations. Mergers present leaders with (real or perceived) threats to their own job security and that of their staff. But it is no doubt more complicated than that.

In addition, it’s easy to forget that most for-profit mergers (more than 80% by some recent measures) fail to achieve the goals of the merger. For nonprofits the risks of merger are essentially the same in as in business—but the rewards “are much smaller and less tangible,” yielding a less favorable calculus overall. As with business, if nonprofits are going to create value through greater collaboration, a host of questions must first be addressed:

- Which organization(s) are sufficiently similar in purpose and goals, but ideally with different but complementary skill sets—“something to offer you, and something you need?”

- How can alignment between the boards be established?

- What branding is optimal? For example, rather than taking one brand or the other, nonprofit brands could be arrayed on the website as business units.

- What steps will incentivize leaders to give up place or power? (A good severance package probably doesn’t hurt!)

- How will new roles be defined for senior staff? The risks (and pushback) here may depend on the motivating rationale for the merger (increasing scope isn’t a threat, streamlining probably is).

And that’s just a few of the questions that need answers. A number of tools have been developed to help. Bridgespan has a whole series of papers and blogs dedicated to the topic. Other resources include the Foundation Center’s Nonprofit Collaboration Database, which provides detailed information on more than 650 collaborations nominated for the Lodestar Foundation Collaboration Prize.

But perhaps the most important challenge in the nonprofit sector (or at least the most relevant to my work) is funding: For good due diligence beforehand to proactively identify likely problems; and for successful implementation—keeping in mind that merged organizations may need more (not less) funding to increase impact.

Given all of the promise (and challenge) that nonprofit mergers present, I was pleased to hear that two colleagues of ours in the campaign finance reform space, Fund for the Republic (a Hewlett Foundation grantee) and Americans for Campaign Reform, just joined forces to become Issue One. This is a great example of something I hope we see more of, if and when it makes sense.

Given the potential benefits and the clear pitfalls to avoid, I’m left wondering: When and how should funders encourage mergers among our grantees?